Secure Your Legacy with Estate Planning

Estate planning is much more than simply drafting a will, it's a thoughtful strategy to ensure your assets and intentions are clearly protected, minimizing burdens for your loved ones, and establishing a lasting legacy for future generations. Here’s why estate planning matters, and how you can take steps to secure your legacy.

What is Estate Planning, and Why is it Important?

Estate planning is the process of outlining how your assets such as property, investments, and personal belongings, will be managed and distributed after your passing. It also involves making important decisions about your future care in case you become unable to make these choices yourself. Regardless of your age or wealth, a thorough estate plan is essential for anyone who wants to safeguard their family, finances, and values.

The Key Benefits of Estate Planning

-

Designate Guardians for Minor Children

By legally naming guardians, you ensure that your children are cared for by people you trust, safeguarding their future care and financial security. -

Minimize Taxes and Legal Fees

Estate planning strategies, such as trusts and strategic gifting, can minimize estate taxes and legal fees, helping you preserve more of your legacy for your heirs. -

Prevent Family Disputes

A clear, legally-binding plan minimizes confusion and helps avoid conflicts among family members, making sure your intentions are honored and reducing stress during difficult times. -

Control Asset Distribution

Without an estate plan, state laws and courts may determine how your assets are distributed, which may not align with your wishes. An estate plan puts you in control, ensuring specific assets go to the people or causes you care about most. -

Plan for Incapacity

Through documents like powers of attorney and healthcare directives, you can appoint trusted individuals to make financial and medical decisions on your behalf if you become incapacitated. -

Preserve and Pass on Values

Estate planning can go beyond just finances. It’s an opportunity to impart values, ethical lessons, and family stories through letters or ethical wills, ensuring your principles are carried forward.

Building Your Comprehensive Estate Plan

A robust estate plan usually includes several key components:

-

Will: Outlines asset distribution and names guardians for minor children.

-

Trusts: Allow for tax benefits, special needs planning, and asset protection.

-

Power of Attorney: Designates someone to manage finances or make healthcare decisions if you’re unable.

-

Advance Healthcare Directive/Living Will: Specifies your medical care preferences.

-

Beneficiary Designations: On retirement accounts, life insurance, and other assets.

It’s also wise to regularly review and update your plan as life circumstances change, such as after marriage, divorce, birth of a child, or significant changes in assets.

Estate planning offers peace of mind, knowing that your loved ones are protected and your legacy is secure. Whether your estate is modest or considerable, starting the planning process early and seeking professional advice can help you make informed choices and ensure your intentions are carried out faithfully.

MIT Federal Credit Union has partnered with Gentreo to offer our members an exclusive offer on their next-generation, modern solution to estate planning. Fully customizable and affordably priced, Gentreo fills an important void in your financial plan, supporting you every step of the way throughout your life and beyond.

« Return to "Blog"

The Benefits of Having a Checking Account

Here’s what you need to know about this account’s benefits and how to best manage it.

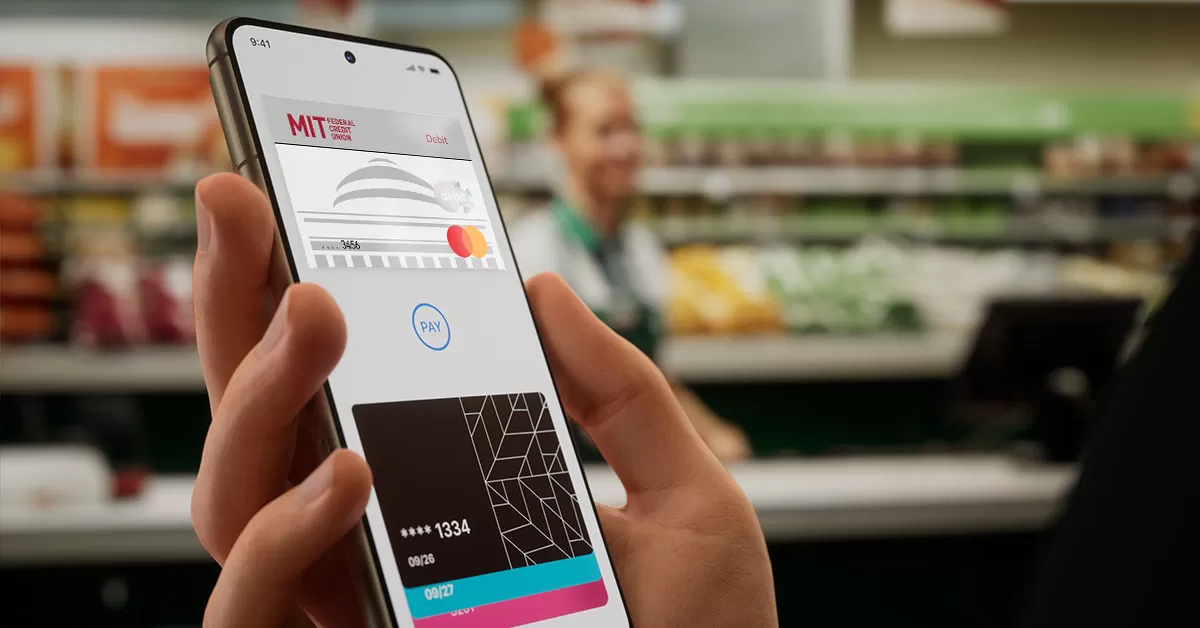

How To Stay Safe With The Wallet Of The Future

Whether you’re an Apple fan or a Samsung supporter, mobile wallets are an efficient, secure way to pay.

Protecting Your Finances While Traveling

Whether you’re heading across the globe or just out of town, follow these tips to keep your money and information safe while you travel.