Belong to more than just a bank

We are not a bank, and that's an advantage for our members. Experience the credit union difference today.

Why us?

It matters where you bank. Where you choose to bank isn’t just about managing your money—it’s about fueling the values of the institution you choose. At MIT Federal Credit Union, your money has the power to shape the community you live in. Every deposit, loan, and partnership helps to sustain and strengthen the place we call home.

Unlike traditional banks, we are not-for-profit and member-owned. Instead of having shareholders focused on profits, our volunteer Board of Directors is focused on making a difference.

Less Fees

As a not-for-profit cooperative, we can give back with lower fees, better rates, and more personalized service. Get started with no monthly maintenance fees on your Checking and Savings Accounts. We care about your success—not shareholder profits.

Peace of Mind

We offer the same products and services as a bank. With trusted safeguards and modern technology, your money is safe every step of the way. As a federally insured credit union, the National Credit Union Association (NCUA) protects your deposits up to $250,000.

Community Impact

Whether it's through a financial literacy workshop or a scholarship opportunity, we work hard to find creative and meaningful ways to connect and show up for our communities. We strive to foster meaningful partnerships with local and campus organizations.

Certificates

Rates as high as

3.50% APY1

Learn moreMinimum daily balance required to earn APY is $500.00.

Who can join?

If you are a part of the MIT community, an immediate family member, partner, or roommate of a person who qualifies for membership, or if you work for one of our partner associations, you can become a member.

If you don't belong to one of those groups, you can still become a member by joining the American Consumer Council (ACC). Don't worry—we can take care of the process for you!

Begin with a Savings Account

A savings account (called a savings 'share' account) with a $5 minimum balance is required to establish and maintain membership. That $5 represents your ownership share in the Credit Union because once you become an MIT FCU member, you also become an owner.

To open, you will need:

- Social Security number*

- Driver’s license or government ID

- Current home address

- Credit card or bank account and routing number to fund your account

Note: You’ll need these for any joint owners you’d like to add.

*If you don't have a social security number, you can still apply.

Bank

Designed to meet your checking and savings needs, you'll take advantage of features such as direct deposit, digital banking, and remote check deposit. All deposit accounts at MIT FCU are federally insured by the NCUA up to $250,000.

Borrow

Discover a suite of lending products designed to meet your financial needs. MIT FCU also offers specialized options such as fuel assistance, rental assistance, and accessibility lifestyle loans.

Funding community change since 1940

When our communities thrive, we all thrive. We are proud to stand by our neighbors who are making a difference in MIT, Cambridge, Lexington, and beyond. Our "People Helping People" motto extends past the work we do in our branches. We strive to find creative ways to uplift our communities through valuable events, partnerships, volunteering, internship opportunities, and charitable donations.

Annual Memorial Scholarships & Awards

We celebrate recipients for their enduring, stand-out commitment to bettering their communities.

Building Stronger Futures with Bridges Homeward

MIT FCU donates to and attends events for Bridges Homeward, an organization offering foster care, family services, and more.

Learn more

Fulfilling Dreams with A Bed for Every Child

Through book drives and the annual Build-a-Bed event, we join the CCUA in its mission to give children a bed to call their own.

Benefits for the whole family

Immediate family such as parents, siblings, children, grandparents, spouses, and those living in your household can become members. This means your loved ones can enjoy the same great rates, personalized service, and financial benefits that you do.

Meet Talleeb: Member Experience Manager

“The concept of People Helping People to me speaks to empathy. Our ability to put ourselves in the members' shoes with any of their needs propels us to put our best foot forward in every exchange we have with them. I'm proud to be a part of a team that leads with a sense of work ethic and care focused on making the experience better for our members.

I enjoy writing, I'll watch the movie Goodfellas every time it's on, my kids are already funnier than me, and everyone should go to The Mad Monkfish restaurant."

Community About MIT FCUThe Credit Union Difference

We are not a bank, and that's an advantage for our members. As a credit union member, here's how you benefit.

At credit unions, members are owners; we answer to them, not investors. Each member has equal ownership.

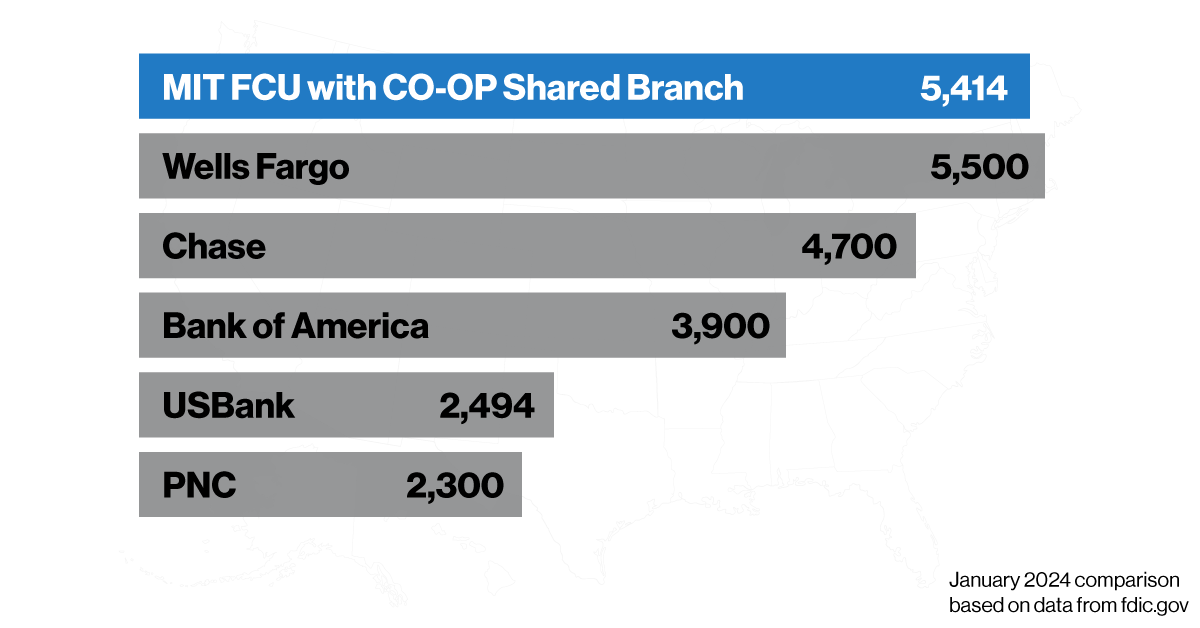

Thanks to the CO-OP branch network, you can access over 30,000 fee-free ATMs and over 5,600 branch locations nationwide.

Credit unions are not-for-profit cooperatives that give back to their members with great savings rates and lower loan rates.

Throughout the history of U.S. credit unions, taxpayer funds have never been utilized to rescue a credit union.

Credit union deposits are insured up to $250,000 by the National Credit Union Administration (NCUA), a federal government agency.

Bank when and where you want.

With mobile and online banking, two convenient branches on campus, access to over 30,000 ATMs, and 5,000 branches nationwide.

Download our highly rated mobile app!4

Financial Wellness

Our Financial Wellness Blog offers practical tips, insights, and guides to ensure you’re taken care of every step of the way. To us, financial wellness goes beyond the numbers. We provide the tools and knowledge to reduce stress, build confidence, and foster smarter financial decisions.

The Credit Union Difference: The History of Credit Unions

Learn about the differences between credit unions and banks.

Continue reading

The Importance of Being Financially Fit

Are you ready to stretch those financial fitness muscles? We hope so, because it’s time to get financially fit!

Continue reading

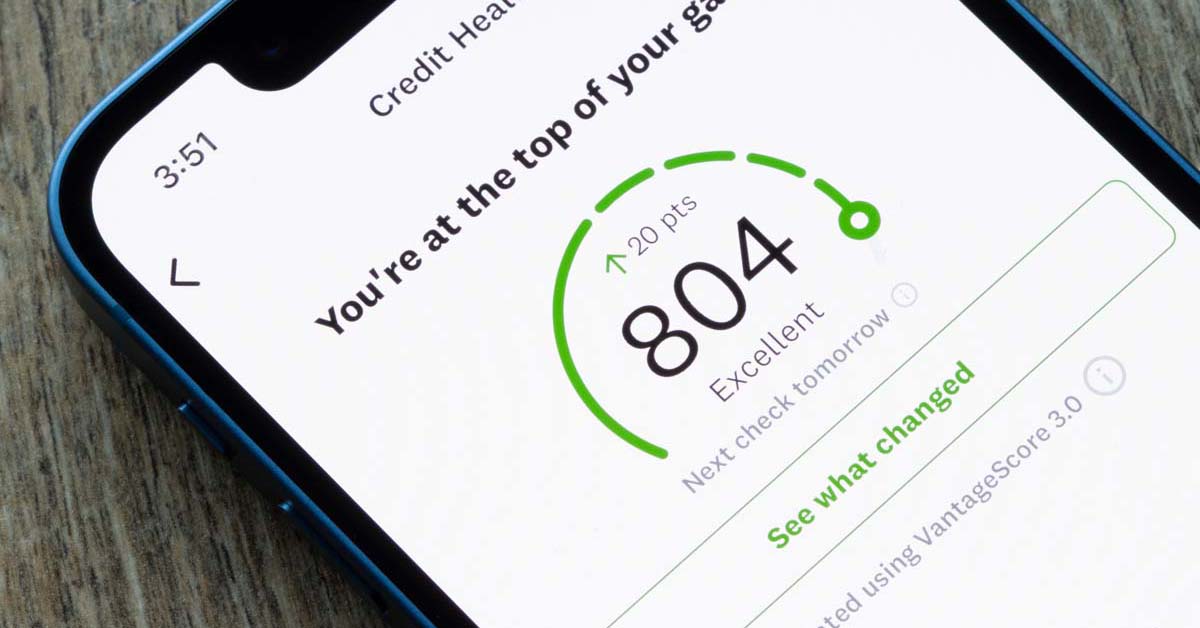

The Importance of Credit Health

Everyone should make a habit of reviewing their credit health regularly. Here's why.