Here to help you reach your goals

MIT FCU is here to support our students with a variety of services.

Special benefits just for students

At MIT FCU, we understand students' unique banking needs. We're here to help you achieve your academic goals today, and will continue to be there for your future financial needs.

Students choose MIT FCU for:

- One on-campus branch

- Eight on-campus ATMs

- Checking account specifically designed for students

- Customizable student loans

- Lifetime membership

Student Checking Account

This account is specifically for students aged 16 to 23. Whether you're in high school or away at college, we have you covered.

- One free incoming wire per semester

- No fee for overdrafts under $10.00

- Up to 8 free withdrawals/month at any ATM

- Free replacement Mastercard debit/ATM card (up to 2 free per year)

- Free cashier's checks

- No minimum balance

Invest in your education with a student loan

MIT Federal Credit Union understands how important affordable education is. That's why we partnered with Student Choice to provide guidance and flexible solutions for your undergraduate education.

Apply now, borrow later

Determining your college funding needs may be a challenge. Even if you're unsure of the college you'll be attending or the loan you'll need, you can establish your private education line of credit today.

Refinance your student loan

Refinance and consolidate your current private and federal student loans (including PLUS loans) into one manageable loan. You may find a better rate while consolidating your payments.

Branches & ATMs

With one on-campus branch and eight on-campus ATMs, students will find an MIT FCU location whenever they need us. Plus, you'll find a second local branch and access to numerous ATMs in the surrounding area.

Visit our branch locator to find a location, get directions, and view business hours.

Branch locatorBegin with a savings account

A savings account (called a savings 'share' account) with a $5 minimum balance is required to establish and maintain membership. That $5 represents your ownership share in the Credit Union because once you become an MIT FCU member, you also become an owner.

To open you will need:

- Social Security number*

- Driver’s license or government ID

- Current home address

- Credit card or bank account and routing number to fund your account

Note: You’ll need these for any joint owners you’d like to add.

*If you don't have a social security number, you can still apply.

Benefits for the whole family

Immediate family such as parents, siblings, children, grandparents, spouses, and those living in your household can become members. This means your loved ones can enjoy the same great rates, personalized service, and financial benefits that you do.

Meet Nick: Member Experience Manager

"For our team, People Helping People means earning our members’ trust by showing commitment, genuine interest, and integrity at any moment and in every single interaction. It’s not only about being in their shoes, it’s about seeing their situations through their eyes.

I love running, I run as much as I can. I love also writing Sci-fi, and some of my stories come to my mind while running, so the more interesting the plot, the longer the run. My family is everything to me, and there is no better reward than coming home after my daily activities.”

Community About MIT FCUFinancial Wellness

How Much Should I Keep in My Checking Account?

Here are three reasons you want to keep your checking account well-padded at all times.

Continue reading

How to Teach Your Kids About Money

Some experts say that children's money habits are formed by the time they are seven, so it's best to start early.

Continue reading

The Importance of Being Financially Fit

Are you ready to stretch those financial fitness muscles? We hope so, because it’s time to get financially fit!

Continue reading

The Credit Union Difference

We are not a bank, and that's an advantage for our members. As a credit union member, here's how you benefit.

At credit unions, members are owners; we answer to them, not investors. Each member has equal ownership.

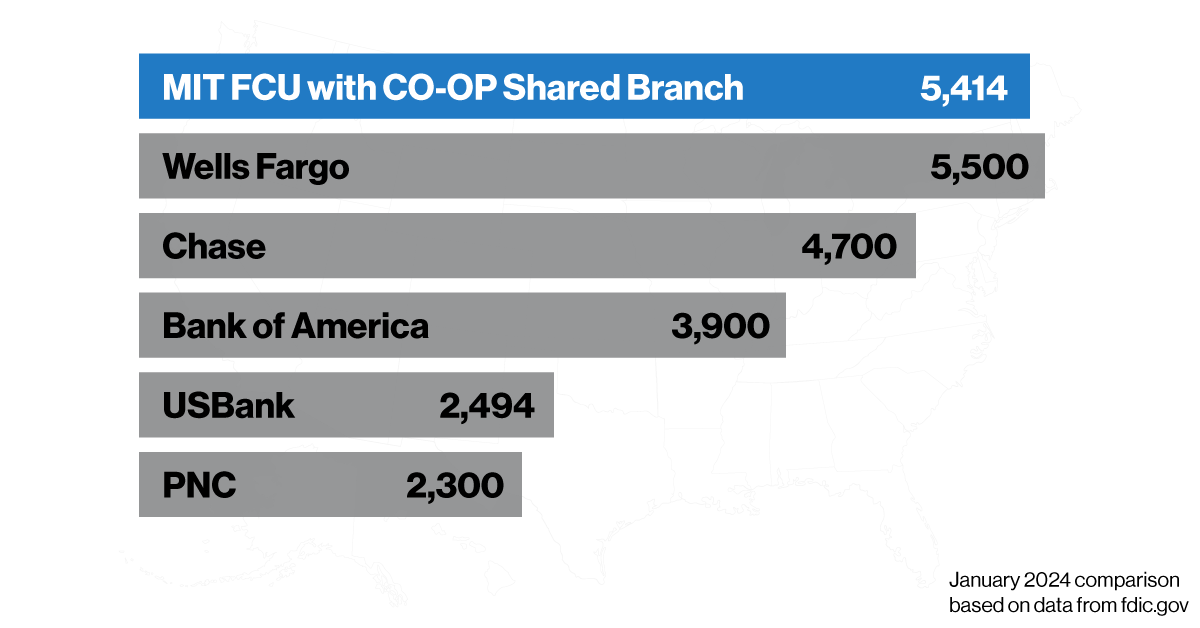

Thanks to the CO-OP branch network, you can access over 30,000 fee-free ATMs and over 5,600 branch locations nationwide.

Credit unions are not-for-profit cooperatives that give back to their members with great savings rates and lower loan rates.

Throughout the history of U.S. credit unions, taxpayer funds have never been utilized to rescue a credit union.

Credit union deposits are insured up to $250,000 by the National Credit Union Administration (NCUA), a federal government agency.

Bank when and where you want

With mobile and online banking, two convenient branches on campus, access to over 30,000 ATMs, and 5,600 branches nationwide.

Download our highly rated mobile app!4