Grow your personal savings

Whether you want to save for a rainy day or book that dream vacation, choose the MIT FCU Savings account that will help you achieve your financial goals.

5.00% APY1

Up to and including the first $2,000.00

- $5 minimum to open

- Higher interest with greater balance

- Easy access via withdrawals and transfers

Choose your Savings account

Basic Savings

A Basic Savings account gets your membership started, and is perfect for kids, too!

- No monthly maintenance fees30

- $5 minimum balance to open

- Federally insured up to $250,000 by the NCUA

Select Savings

Select Savings is an elevated account for members interested in a simple solution for short-term savings.

- Earn higher dividends on a minimum daily balance of $25,000

- Dividends compound daily and pay out monthly

- Federally insured up to $250,000 by the NCUA

Vacation & Holiday Club Savings

Vacation Club - Get started saving for your summer project, graduation gift, or annual vacation.

- Dividends compound daily and pay out monthly

- Vacation club funds automatically transfer - June 15th

- Strategic planning with anytime access to funds

- Initial deposit limit of $2,500

Holiday Club - Make the holidays merrier by preparing for winter heating expenses and holiday spending.

- Dividends compound daily and pay out monthly

- Holiday club funds automatically transfer - October 15th

- Strategic planning with anytime access to funds

- Initial deposit limit of $2,500

| Product | Minimum Daily Balance to Earn | Dividend Rate | APY 10 | Apply Now |

|---|---|---|---|---|

| Savings | $100.00 | 0.05% | 0.05% | Open account |

| High Yield Savings | $500.00 | 2.96% | 3.00% | Open account |

| IRA Share (Traditional & Roth) | $100.00 | 0.05% | 0.05% | Open account |

| Select Savings | $25,000.00 | 0.10% | 0.10% | Open account |

| Club Accounts | None | 0.05% | 0.05% | Open account |

| Starter Savings | Up to and including the first $2,000.00 | 4.88% | 5.00% | Open account |

| On remaining balance above $2,000.00 | 0.05% | 5.00% - 0.05% | Open account |

Always have a way to pay with Mobile Wallet

Mobile wallets offer a safe, convenient way to pay with your MIT FCU cards. Our debit card can be used with Apple Pay®, Google Pay™, and Samsung Pay®3. Set up is easy and can be done in seconds.

Continue readingWhat could my recurring (monthly) savings grow to?

Different factors can impact the growth of your savings over time such as the frequency of deposits and the rate of compounding. Use this calculator to determine the future value of your recurring savings and any existing balance you might have accumulated.

Bank when and where you want

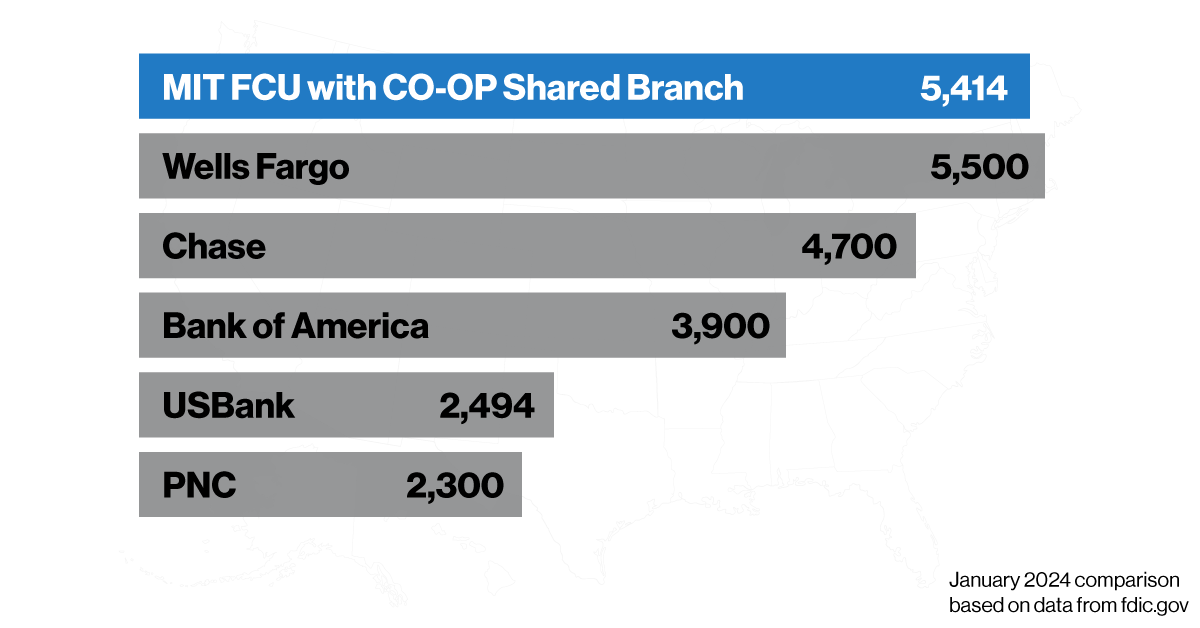

With mobile and online banking, two convenient branches on campus, access to over 30,000 ATMs, and 5,600 branches nationwide.

Download our highly rated mobile app!4

Financial Wellness

Our Financial Wellness Blog offers practical tips, insights, and guides to ensure you’re taken care of every step of the way. To us, financial wellness goes beyond the numbers. We provide the tools and knowledge to reduce stress, build confidence, and foster smarter financial decisions.

Simple Steps to Boost Your Savings

Here are seven simple steps that can get you on the fast track to building your savings today.

Continue reading

The Importance of Being Financially Fit

Are you ready to stretch those financial fitness muscles? Being financially fit is crucial for a well-balanced, stress-free life.

Continue reading

Pumping Up Your Savings Routine

Here are some tips to get you moving toward that down payment, and how you can compare it to your workout regimen.

Continue reading