Where will you go with an Auto Loan from MIT FCU?

An Auto Loan from MIT FCU provides the confidence needed to get the deal you want. You'll know your rate and term ahead of time and can negotiate with all the facts in mind. We put you in charge when it comes to financing a new70 or used vehicle.

| Product | Term | APR1 | Estimated Monthly Payment per $1000 | Apply Now |

|---|---|---|---|---|

| New Auto | 60 Months | 5.25% | $18.99 | Apply now |

| 72 Months | 6.00% | $16.58 | Apply now | |

| 84 Months | 7.25% | $15.22 | Apply now | |

| Used Auto | 60 Months | 5.75% | $19.22 | Apply now |

| 72 Months | 6.50% | $16.81 | Apply now | |

| 84 Months | 7.75% | $15.47 | Apply now |

What we offer

Low fixed-rate/term

- We offer competitive rates and terms based on your credit score. Apply now and save.

APR discounts

- Automatically qualify for APR1 discounts when you set up automatic loan payments. Hybrid/electric vehicles qualify for additional discounts.

Additional benefits

- 100% financing may be available

- No service fees or prepayment penalty

Will you owe more on your vehicle loan than your vehicle is worth?

MEMBER'S CHOICE® Guaranteed Asset Protection (GAP) Coverage pays the difference between your insurance settlement and your auto loan's outstanding balance if your car is stolen or totaled in an accident.

Get GAP today so you can worry a little less about tomorrow.

Get startedAuto Buying Center

Search for Your New or Used Vehicle

- CUDL AutoSMART - Search for vehicles at nearby dealerships

- AutoTrader - Research and locate vehicles

- Cars.com - Research and locate vehicles

New and Used Vehicle Resources

- Kelley Blue Book - Price new vehicles and trade-in value

- Edmunds - Upfront pricing on new and new-to-you vehicles

- Car and Driver - The latest from a leading automotive resource

What would my auto payments be?

Many factors go into determining the final loan amount for the purchase of a new or used vehicle. These factors include any manufacturer's rebate, the trade-in value of your old vehicle less any outstanding balance, your down payment, etc. Once the loan amount is determined the interest rate and the term of the loan will be used to estimate your vehicle payment.

The Credit Union Difference

We are not a bank, and that's an advantage for our members. As a credit union member, here's how you benefit.

At credit unions, members are owners; we answer to them, not investors. Each member has equal ownership.

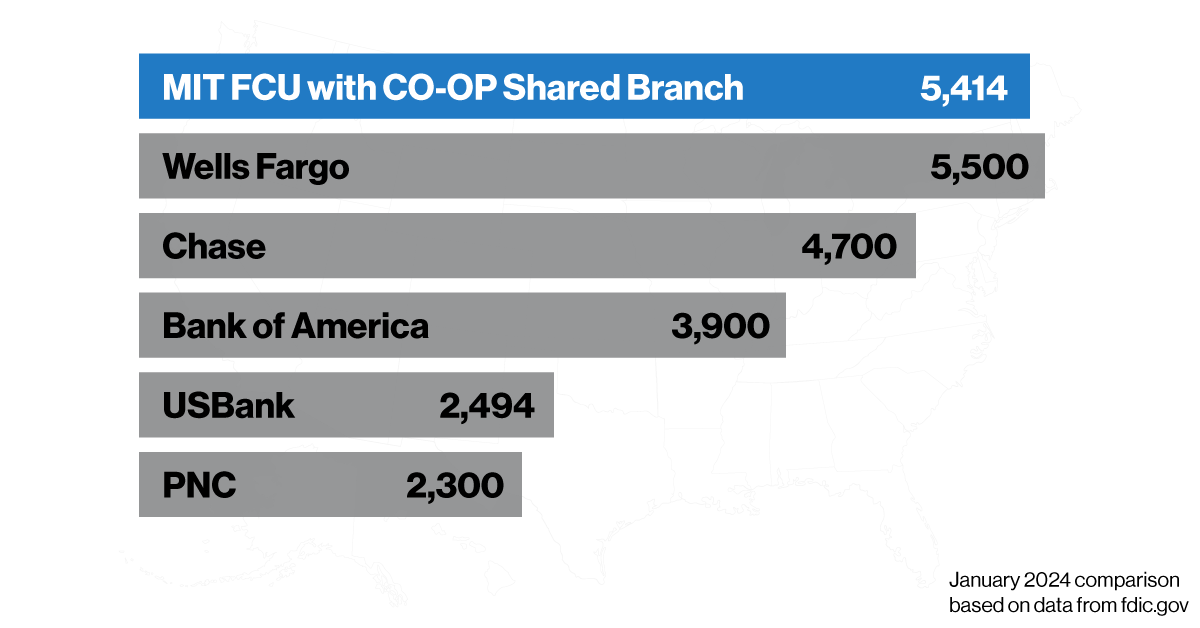

Thanks to the CO-OP branch network, you can access over 30,000 fee-free ATMs and over 5,600 branch locations nationwide.

Credit unions are not-for-profit cooperatives that give back to their members with great savings rates and lower loan rates.

Throughout the history of U.S. credit unions, taxpayer funds have never been utilized to rescue a credit union.

Credit union deposits are insured up to $250,000 by the National Credit Union Administration (NCUA), a federal government agency.

Financial Wellness

Our Financial Wellness Blog offers practical tips, insights, and guides to ensure you’re taken care of every step of the way. To us, financial wellness goes beyond the numbers. We provide the tools and knowledge to reduce stress, build confidence, and foster smarter financial decisions.

Auto Loans: Credit Unions Vs. Banks

Credit unions are known for having lower fees and interest rates than banks.

Continue reading

All You Need to Know About Auto Loans

If you’re in the market for a new car or truck, you’re likely also shopping for an auto loan.

Continue reading

Navigating the Current Auto Loan Market

Here’s what you need to know about the current auto loan market and how to navigate it successfully.

Continue readingBank when and where you want

With mobile and online banking, two convenient branches on campus, access to over 30,000 ATMs, and 5,600 branches nationwide.

Download our highly rated mobile app!4

FAQs

FAQs - Vehicle Lending