Get more with our Basic Checking Account

No monthly maintenance fees30 and you can manage your money when and where you want.

What are you looking for in a Basic Checking account?

Whether you're funding lofty goals or handling everyday banking, let's make it possible with a personal checking account from MIT FCU.

No maintenance fees

Stop paying those fees to your bank with our no-hassle checking accounts.

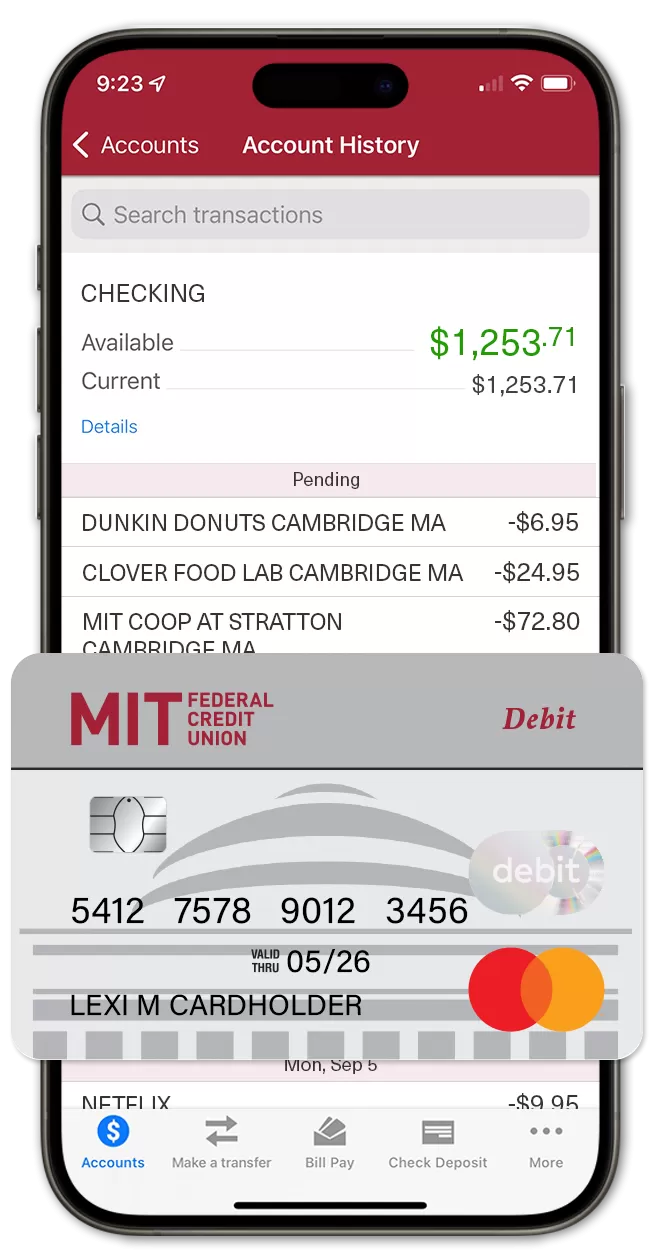

24/7 Account Access

Access your account with mobile and online banking anytime, anywhere.

Mastercard® Debit

Make purchases and withdraw funds. Compatible with Apple Pay®, Google Pay™, and Samsung Pay®3.

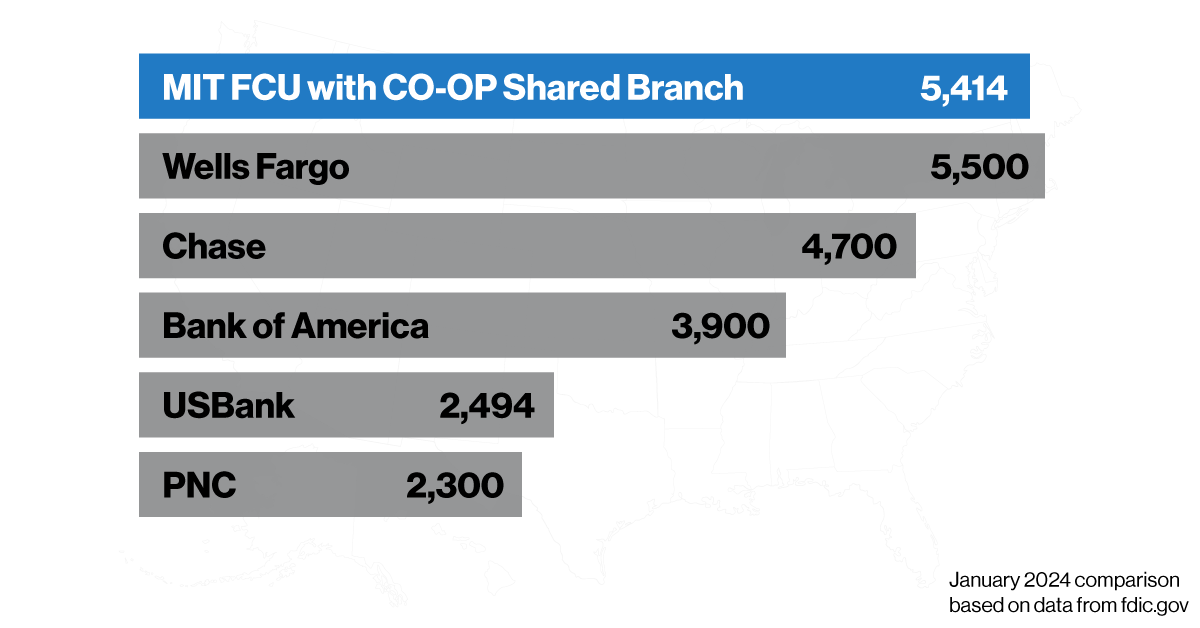

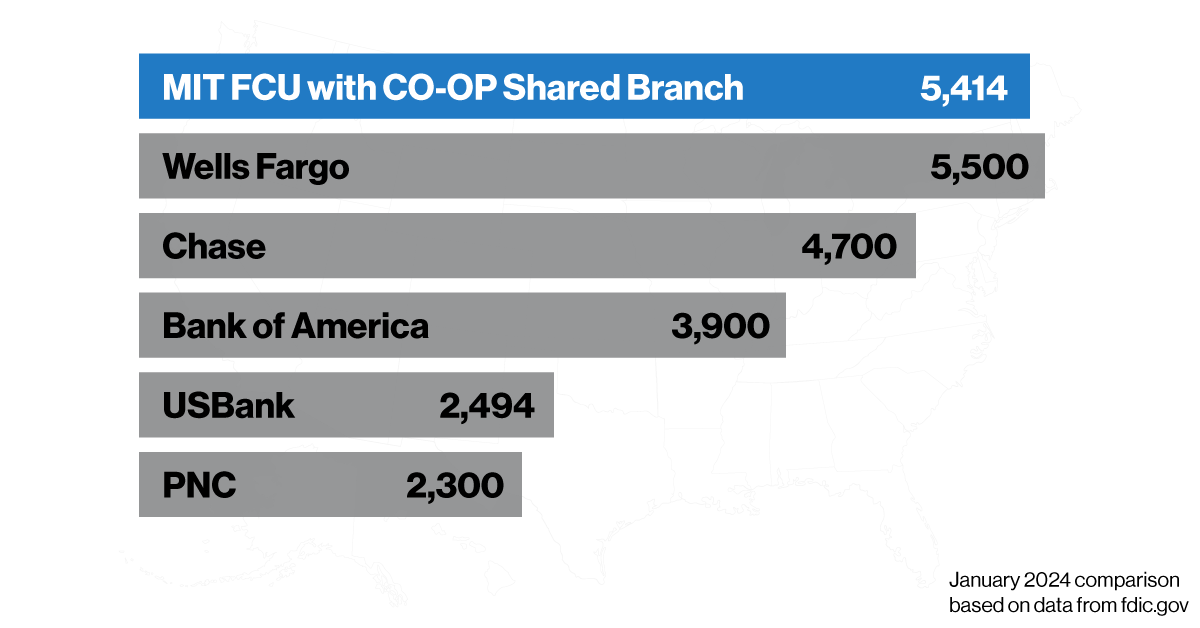

5,600+ branches & 30,000 ATMs

MIT FCU has branches and ATMs across the country. Regardless of your location.

Receive your paycheck up to two days early!

When you set up direct deposit, you can get access to your paycheck up to two days early.31

Insured by the NCUA

Insured by the NCUA up to $250,000.

| Product | Minimum Daily Balance to Earn | Dividend Rate | APY 10 | Apply Now |

|---|---|---|---|---|

| Select Checking | $100,000.00 | 0.05% | 0.05% | Open account |

| $50,000.00 | 0.05% | 0.05% | Open account | |

| $25,000.00 | 0.05% | 0.05% | Open account | |

| $10,000.00 | 0.05% | 0.05% | Open account | |

| Plus Checking | $2,500.00 | 0.05% | 0.05% | Open account |

| Basic Checking | N/A | N/A | N/A | Open account |

Looking for more with your checking?

Choose one of our interest bearing checking accounts.

Get your credit score and more

Receive your credit score and more with an MIT FCU account. Just enroll through mobile and online banking.

- Get daily access to your credit score.

- Daily credit report monitoring.

- Financial checkup with detailed spending and cash flow overview.

- Credit score simulator to help plan how to improve your score.

Smart Money Rewards Checking-

With direct deposit of at least $100/mo you will receive the following rewards:

Overdraft Protection - Avoid costly fees for insufficient funds.

Debit Mastercard® & ATM Cards

- Reimbursement up to $5 in ATM surcharges each month on out-of-network ATMs (after 8 free out-of-network transactions)

- Free replacement of your lost, stolen, or damaged MIT FCU ATM or Debit Mastercard® (up to 2 replacements per year)

- Free starter box of basic, single checks. Please contact us at 781-423-2022 for assistance with your order

- Surcharge free access: SUM, CO-OP, MoneyPass, NYCE, and Cirrus network ATM Machines, plus 8 free ATM transactions at non-network ATMs per month

- Enhanced card fraud protection

Student Checking Account

This account is specifically for students aged 16 to 23. Whether you're in high school or away at college, we have you covered.

- One free incoming wire per semester

- No fee for overdrafts under $10.00

- Up to 8 free withdrawals/month at any ATM

- Free replacement Mastercard debit/ATM card (up to 2 free per year)

- Free cashier's checks

- $5 minimum opening deposit

Always have a way to pay available with Mobile Wallet

Mobile wallets offer a safe, convenient way to pay with your MIT FCU cards. Our debit card can be used with Apple Pay®, Google Pay™, and Samsung Pay®3. Set up is easy and can be done in seconds.

Continue readingNeed to Order Checks?

Now offering checks through Main Street, Inc. All first-time orders with Main Street will be required to start with Check #101.

If your last order of checks was placed prior to 02/01/2022, please contact us by chat bubble, visit a branch, or call (781-423-2022 Mon-Fri 8 am-5 pm EST) for assistance in placing your order with Main Street, Inc.

Members are able to re-order checks online. Click below to re-order checks or view your order status online.

Order checks

Bank when and where you want

With mobile and online banking, two convenient branches on campus, access to over 30,000 ATMs, and 5,600 branches nationwide.

Download our highly rated mobile app!4

Financial Wellness

Our Financial Wellness Blog offers practical tips, insights, and guides to ensure you’re taken care of every step of the way. To us, financial wellness goes beyond the numbers. We provide the tools and knowledge to reduce stress, build confidence, and foster smarter financial decisions.

The Benefits of Having a Checking Account

Here’s what you need to know about checking account benefits and how to best manage it.

Continue reading

Direct Deposit: Safe, Simple, and Convenient

Let’s look at three reasons why direct deposit is right for you.

Bank when and where you want

With mobile and online banking, two convenient branches on campus, access to over 30,000 ATMs, and 5,600 branches nationwide.

Download our highly rated mobile app!4