What is a Share Certificate?

A Share Certificate is a type of savings account that holds a fixed amount of money for a fixed period of time. In exchange for not touching the money, you can earn higher returns than a regular savings account. A share certificate is the credit union equivalent of a certificate of deposit (CD) from a bank.

What is a share certificate vs. CD?

Share certificates and CDs operate in the same way. A certificate of deposit (CD) is offered by a for-profit bank, while a share certificate is offered by member-owned, not-for-profit credit unions. Because of this ownership structure, the earnings on share certificates are called dividends, while the earnings on CDs are called interest. Share certificates are also insured by the NCUA rather than FDIC.

When it comes to choosing between a share certificate and a CD, the institution is the deciding factor. Credit unions are known for offering better yields than brick-and-mortar banks. This is thanks to the not-for-profit structure, which allows credit unions to pass savings onto members through higher rates and lower fees.

How does a share certificate work?

First, choose a term length that aligns with your financial goals. If you have a short-term goal, 6 months or 1 year might be suitable. A shorter term is also best if you think you’ll need the money sooner. If you have long-term goals, such as saving for a down payment on a house or retirement, a longer term of 3 to 5 years might be suitable. If you know you won’t need the money for a while, you can take advantage of the higher dividend rates.

Next, simply leave the money untouched and let the earnings stack up. Once the term ends, you can withdraw your money plus the dividends you’ve accrued.

When should I consider getting a share certificate?

Share certificates are ideal for sums of money that don’t need to be accessed for some time. If you have savings just sitting there, a share certificate can be a great option for a diversified savings strategy.

Short-term goals – In the short term, share certificates can aid in saving up for large purchases, like a car, a house, or funding education.

Long-term goals – In the long term, share certificates can aid in reaching your retirement savings goals. A Roth IRA certificate offers tax-free withdrawals of contributions at any time, while a traditional IRA certificate may have penalties and taxes.

What are the benefits of a share certificate?

Most notably, share certificates offer higher dividend rates than a regular savings account. This makes them an attractive option for diversifying your savings plans and earning more on your savings.

Fixed rates – The dividends on a share certificate is fixed for the length of the term. This protects you from fluctuations in dividend rates. It also means you’ll have guaranteed gains and know exactly how much you’ll earn from the offset.

Flexibility – Share certificates offer a variety of term lengths. You can choose the length that fits your timeline, whether it’s for a short-term or long-term savings goal.

Safety and security – Share certificates are insured by the NCUA, and thus, a low-risk investment. This allows for peace of mind, ensuring your money is protected up to $250,000.

Are there drawbacks to a share certificate?

There are a few things to remember when getting a share certificate. Keep in mind that withdrawing funds early can result in a penalty. You'll have limited liquidity once you’ve locked into a share certificate. This means you could miss out on higher earning potential until your term ends.

Additionally, the inflation risk is something to keep in mind. If the inflation rate is higher than the dividend rate on your share certificate, the purchasing power of your money could decrease over time.

Start saving more today with MIT Federal Credit Union

Diversify your savings plans and save with the rate and term that fits your needs. MIT Federal Credit Union offers competitive rates for 3- to 60-month terms with a minimum deposit of $500. Our team is here to help you make the most of your money—open an account and start earning today!

« Return to "Blog"

Why Choose a Certificate Instead of a Traditional Savings Account?

When it comes to saving money, most people think of a traditional savings account. However, they don’t always offer the best growth potential.

How Much Should I Keep in My Checking Account?

Here are three reasons you want to keep your checking account well-padded at all times.

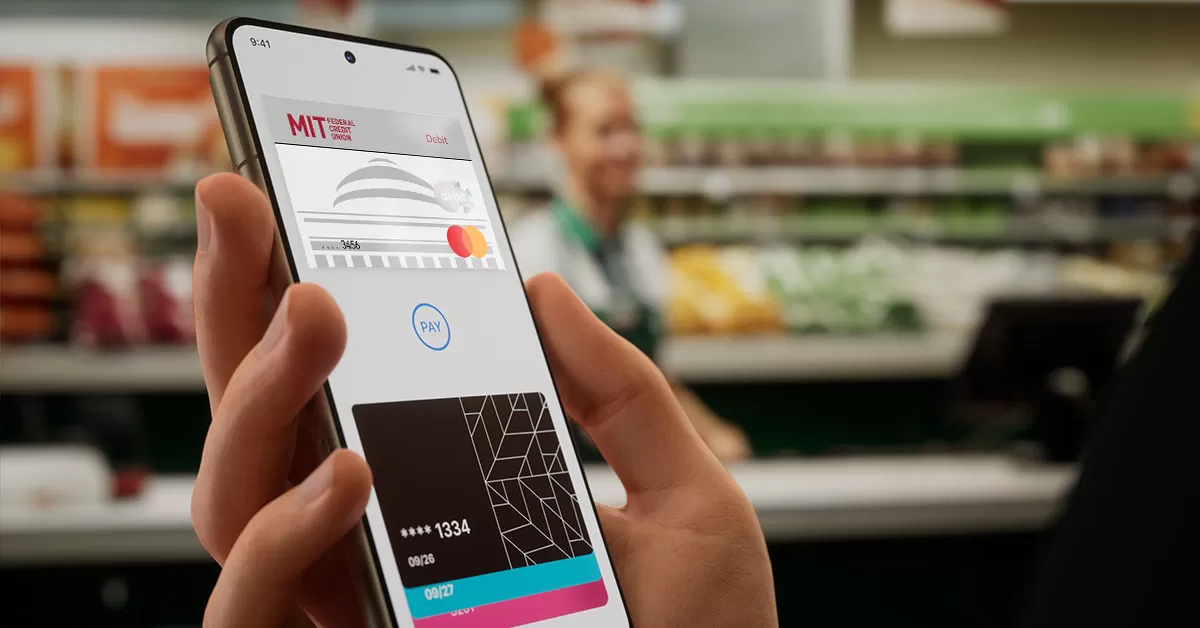

How To Stay Safe With The Wallet Of The Future

Whether you’re an Apple fan or a Samsung supporter, mobile wallets are an efficient, secure way to pay.