STUDENT TALK What Even is a Credit Score?

Building credit is extremely important in the US, even if you don’t need to borrow money. It’s not only used in buying a house or a car but also in finding a job or a place to rent. In fact, it comes up in places you may be surprised to find including things like qualifying for home and auto insurance! For a student who may never have had a discussion about credit, the topic can be very confusing. Growing up I had the fortune of learning good financial practices from my mother. She worked as a bank teller for most of my childhood and was always sharing information with me. I hope the following information opens a door to a greater understanding of credit and how it can impact your future financial life.

What is credit?

In general terms, credit, or getting a loan, involves a contractual agreement between a borrower and a lender. The borrower receives something of value (i.e., money) from the lender with the agreement that the borrower will repay the lender in full (usually with interest) over an agreed-upon timeframe. A common example of this is the credit card. When you use a credit card, you are borrowing money from the credit card company so that you have "credit" on account to make a later purchase. The credit card company allows you this credit with the expectation that you will repay the borrowed money. In most instances, if you don’t pay the full balance owed within a month, you will also pay interest on the remaining balance. Check your credit card disclosures. Sometimes you start paying interest as of the purchase date, with other cards it may be after a certain number of days. Credit card agreements can be overwhelming and tedious. The Consumer Financial Protection Bureau (CFPB) provides a great overview of definitions commonly found in credit card agreements.

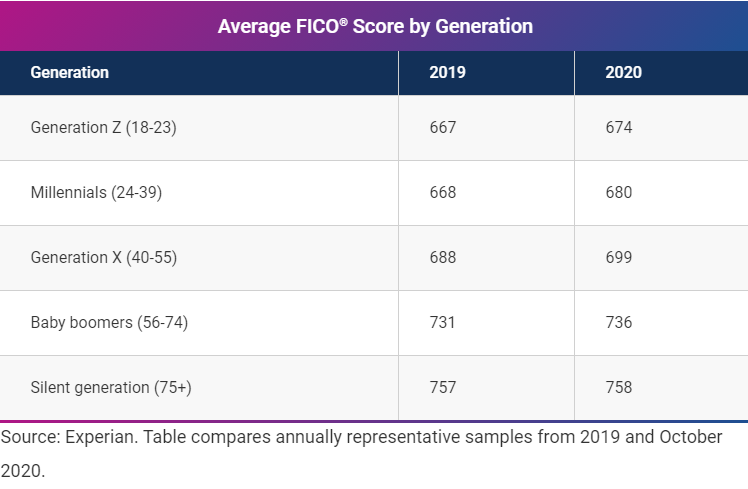

In the US, a credit score system is used to determine a borrower’s credit risk to a lender. The predominant type of credit score is the FICO score. FICO, rhymes with micro... weird name I know. I thought it stood for some magic formula or maybe a big corporation somewhere, but no, FICO was originally named for Bill Fair and Earl Isaac, who came up with a specific credit score algorithm. "F" for Mr. Fair, "I" for Mr. Isaac, and CO for Corporation. Their names are now legend... sort of. In any case, the algorithm they came up with calculates how much of a credit risk specific borrowers have a chance of being for lenders. This algorithm considers certain factors, behaviors and characteristics to determine the likelihood, based on risk ratings and actuarial data, of someone paying their loans on time. VantageScore is another commonly used credit score model. That name isn't quite as interesting, but it works in the same way, just with different criteria and a different algorithm.

How is my credit score determined?

The FICO score algorithm is used for credit score calculations by the three major credit bureaus in the US: Experian, Equifax, and TransUnion. In a nutshell, the following criteria (in varying weights) are considered when calculating your credit score.:

- Your payment history (35%)

- Your total debt (30%)

- Age of your credit history (what is your oldest card or loan) (15%)

- Any new credit you’ve recently acquired (10%)

- Types of credit you’ve used (10%).

Data is collected/reported from/by lenders regarding payment history, original balance, current balance, etc. When you apply for a loan, the lender looks at your record as reported from other lenders. When you close on that loan, the lender you worked with will report your payment history to the credit bureaus so the new loan will be added to your credit report. This is done voluntarily and you don't have the option to prevent a lender from reporting. Other companies report to credit bureaus, too, including medical facilities, doctors, student loans, rent, and more. Public records are also reported to credit bureaus, as well as your name(s), social security number, address(es) and how long you lived there, and more.

Credit scores provided by the bureaus range between 300 and 850. The higher your score, the better it is, and the more likely lenders will trust you to reliably pay off any debts. Some lenders offer risk-based pricing on their loans and credit cards. This means the higher your score, the better your rate may be.

Why are credit scores important?

As mentioned before, credit scores are used to determine your strength as a borrower. A high credit score means you're more likely to repay a loan. A higher credit score can also earn you lower interest rates, higher credit limits, and better terms on loans.

But credit scores have an impact beyond standard personal finance. That's why it's important to build your credit, even if you don't like the idea of taking out a loan or using a credit card. Landlords may check your credit to determine if you'll reliably pay your rent. Many employers run credit reports on new hires as an additional determinant on whether you'll be hired. Insurance companies may run credit reports to assist in determining your rate classification. Basically, credit scores can impact a lot more than whether you'll get a loan and a great rate.

You may be wondering why this is the case. Well, no one ever talks about negative financial behavior in a job interview, and insurance companies are all about risk management. But studies show this negative behavior can be an indicator of other issues. Data collected over a significant period of time indicates that people with bad credit scores pose higher risks. Unfortunately, this association does tend to impact marginalized communities at a higher level. Curious to learn more? This Washington Post column illustrates how the credit score system disproportionately affects Black Americans.

How do I build my credit score?

For college students and young people in general, it may seem like an uphill battle to build a credit score. However, if you start building credit early (for example, at the start of college), you could have a good credit score by the time you graduate. And that's when you need it to start dealing with the costs of adulting (e.g., insurance, rent, buying a car).

Since you can’t typically get a credit card or loan with a lack of credit history, there are options in place to specifically help you build credit:

- A first step to build credit without credit. Apply for a secured credit card, a secured loan, or a credit-builder loan. You can also have someone co-sign a loan or credit card with you. Learn more about these credit-building options here.

- Pay off your student loans. If you have student loans, making payments on them will help you start building credit. You don’t have to wait until forbearance is done. If you can start paying earlier, go for it. But only do that if you have enough to cover actual living expenses. You don't want to put yourself in a position where you can't pay for the necessities.

- Report the bills you pay regularly. If you live off-campus and pay rent and utility bills regularly, ask your landlord if they could report this payment activity to the credit bureaus. Some will, some won't but it's worth the ask. Alternatively, you can keep a record of all payments made. These records, cancelled checks, and payment history in online banking can often be used to show a lender your ability to pay.

For International Students and Other Non-U.S. Citizens

Not a US citizen? During your time in the US, you'll still be subject to the same credit standards. Building your credit score will be especially important if you plan to stay in the US long-term, such as working here post-grad. The advice mentioned above also applies to you, but here are a few extra tips to keep in mind:

- Open a bank or credit union account. Credit scores stem from your financial history here in the US, so opening an account is a good place to start. It doesn’t always require a social security number. MIT Federal Credit Union offers options to their field of membership even if you don't haver a social security number. While debit cards can’t build credit, it can help you with day-to-day transactions while you work on building your credit. It's also a good idea to see if your bank or credit union at home has a location or relationship here in the US. With credit unions, sometimes international offices are linked to the CO-OP Network. This is a cool aspect of many credit unions. They participate in a network that stretches across the US and in some foreign countries and credit unions in that network serve each other’s members, including overseas! It's definitely worth looking into.

- Don't give up on finding a credit card. While uncommon, there are credit cards that can help international students build their credit history in the US. One notable credit card company is Deserve. Founded by an international student, they offer an international student-friendly credit card.

- What if I had a credit score overseas? Unfortunately, your international credit score will not carry over. There are laws in place that prohibit credit information sharing overseas. In like manner, if you start building a credit score here, it will not be carried over if you apply for credit at an institution based in a different country.

- What if I don’t have a social security number? Credit bureaus can still track your credit and payment history, even if you don’t have an SSN. Make sure to keep copies of all your payments and other relevant documentation so you can verify what the credit bureaus track.

How do I maintain a good credit score?

Any credit score of 700 and above is considered good. Financial institutions all have their own range of rankings, Bad, Fair, Good, Very Good. Once you build your credit into this higher range it is crucial to keep it there. Some good habits to develop:

- Making your payments on time. This builds your payment history and shows that you’re a reliable borrower. Making payments on time repeatedly means you're a low credit risk for lenders. If possible, enabling automatic payments can save you some time and brainpower.

- Generally keeping your credit card spending below 30% of your credit limit. Your score will start to suffer if you constantly max out your credit limit, especially if you can’t make on-time payments after maxing it out. But if you pay it in full every month, there's no real history of paying down a balance.

- Don’t constantly open new credit cards or apply for multiple loans. When you do this, lenders make a hard inquiry to get your credit report. This hard inquiry shows up on your record and slightly drops your credit score because it introduces a new factor of uncertainty to your credit history. Lenders aren’t sure what you plan to do with the new line of credit. It can also be seen as you shopping for credit, perhaps being declined repeatedly, or attempting to access a bunch of credit because you are in a bad position financially. If you find yourself approaching one of life's financial milestones, such as buying a house or purchasing a new car, consider the timing of these events to prevent your credit score from taking a big hit. One interesting note: if multiple similar inquiries are made within a short time span, they will count as only one inquiry. For example, if you’re at a car dealership and a dealer submits inquiries to five lenders, the five requests will be seen as one hit to your credit since it’s obvious they’re all for the same thing—a car loan, and they're not being requested off and on constantly over a period of days and weeks. Multiple inquiries being run every few weeks is a red flag for lenders.

- Refrain from closing credit cards. Credit cards are one marker of your credit history and how long you've been managing credit. By closing these accounts, you remove these markers from your credit history. This can reduce your credit score. If you reach a point where you have a very high score and are holding onto a credit card you never use, you can probably afford to lose a few points by closing the card, but consider it carefully.

- Monitor your credit score. You can get a free annual credit report from annualcreditreport.com. Your credit card company and other financial institutions may also provide free services for you to check your credit score via a soft inquiry (an inquiry that will not bring down your credit score). It’s imperative to monitor your credit score, especially if you notice any changes that could indicate fraudulent behavior. You can also use credit score simulators to see how certain financial decisions may impact your credit score.

If you take nothing else from this information dump, I hope you at least take away the following key points:

- Building a credit score is crucial to help you gain opportunities in the US.

- If you have a credit card, try to keep your overall balance below 30% of the credit limit

- Always pay off your debts in a timely manner, and in full when possible

- Monitor your credit score regularly

Sites used for research:

Experian

Investopedia

Khan Academy

Nerd Wallet

« Return to "Blog"

STUDENT TALK 5 Key Factors About Credit Cards

Before you apply for that card, get comfortable with the following key factors.

STUDENT TALK Homebuying 101

The homebuying process can be lengthy and complex, especially if it’s your first time and all that homebuying jargon is unfamiliar.

STUDENT TALK Money Tips for College Students

If the thought of managing your money in college is stressing you out, dig into these tips for some help!